So, in practical terms, how much time do we have to act? Why do these deadlines vary from one situation to another? And above all, how can you avoid missing out on a major claim?

What is a limitation period in debt collection?

The prescription period is the period during which you have the right to claim payment of a debt. Once this period has elapsed, it is impossible to assert your claim in court. It's as if the debt has disappeared... legally, anyway.

In France, the Civil Code sets the rules, but other texts may apply depending on the nature of the claim. The most common? Article 2224 of the French Civil Codewhich sets a 5-year period. It's the "standard" of the genre.

Why do these delays exist?

One might ask: why put a time limit on the possibility of getting paid? Precisely to balance the roles.

- To protect the debtor : no one wants to be harassed 20 years later for a forgotten debt. And then, evidence is lost, documents disappear, memory fails...

- To give creditors a sense of responsibility: it's an incentive not to dawdle. An unpaid invoice must be followed up, dunned and dunned again. If not, too bad.

Practical example :

Company A provides a service to company B in January 2020 and issues an invoice for €5,000. Under ordinary law (5-year time limit), company A must initiate collection proceedings before January 2025. If it fails to do so, B may invoke the statute of limitations and legally refuse to pay the invoice, even though the debt is real.

The moral? If you're a creditor, never let an invoice go dormant. Keep track of your receipts as you would your stock or your key customers.

Limitation periods vary according to the nature of the claim

The tricky part is that there's no single time limit. Depending on the type of claim, the clock runs faster or slower. Here's a detailed overview of the main deadlines to be aware of.

Trade receivables

- Time limit 5 years (article L110-4 of the French Commercial Code).

- Context This period applies to debts between companies, such as unpaid invoices for goods or services.

- Practical example A transport company invoices a business customer for a service in February 2023. If the invoice remains unpaid, the creditor has until February 2028 to take legal action.

💡 Exception: in the transport sector, the time limit is 1 year.

Civil claims

- Time limit 5 years (article 2224 of the French Civil Code).

- Context This includes personal debts between individuals or non-business debts, such as loans between friends or medical expenses.

- Practical example You lend €2,000 to a friend in May 2021. No written contract. You must claim repayment before May 2026. After that, it's too late.

Payroll receivables

- Time limit 3 years (article L3245-1 of the French Labor Code).

- Context Unpaid wages must be claimed within this period.

- Practical example An employee has not received a bonus promised in 2020. He has until 2023 to request payment. After that date, he can no longer legally claim the sum.

Tax receivables

- Time limit : Generally 4 years, according to the article L169 of the French Tax Code.

- Context This period applies to taxes due to the State.

- Practical example If an incorrect tax return was filed in 2019, the tax authorities have until the end of 2023 to claim the amount due.

Rental receivables

- Time limit 3 years (article 7-1 of the law of July 6, 1989).

- Context This period applies to unpaid rent on residential leases.

- Practical example A tenant stops paying from June 2020. The landlord can take action until June 2023.

Specific cases

- Receivables from medical services 2-year statute of limitations (article L1142-28 of the French Public Health Code).

- Merchants' receivables from individuals Limitation period reduced to 2 years (article L218-2 of the French Consumer Code). Electricity/Gas/Water/Telephone/Insurance bills, for example.

- Fines and offences Delays vary depending on the nature of the offence, generally 3 years.

- Enforcement of court rulings applicable time limit: 10 years from the date of the judgment or writ of execution.

Why do these timescales vary?

Because not all situations are created equal.

- Commercial receivables are often more complex: high amounts, more technical disputes... So we give them more time.

- Consumer and wage claims affect people who are often less legally equipped. Hence the shorter deadlines designed to protect them.

So, in your business, do you have a clear vision of the deadlines you need to monitor? This is often where the problems start...

Why is it essential for creditors and debtors to respect these deadlines?

Consequences for creditors

- You lose the right to act: Do you have a claim, but haven't done anything about it in time? Too bad, you won't be able to recover it, even if it's perfectly justified.

- Example A company has an unpaid invoice from March 2018. If no action is taken before March 2023 (5-year deadline), it will be impossible to recover it.

- A direct impact on your cash flow: An outstanding invoice means less cash. And when invoices pile up, your cash flow suffers.

- THE number : nearly 25 % of unpaid receivables in France are lost simply because the statute of limitations has expired.

- It's a disservice to your image : Not keeping track of your receivables is like forgetting to deliver to a customer: it gives the impression of disorganization.

💡 The right reflex: equip yourself with a deadline tracking tool. Even a simple, well-kept Excel spreadsheet can make all the difference.

Consequences for debtors

- The debt is extinguished: If the creditor acts too late, you no longer have to pay - that's the rule. This offers a form of "legal protection" for debtors in the face of overdue claims.

- Example You have a debt of €1,000 dating back to July 2017. No reminders, no letters. In July 2022, you can say "no", and it's perfectly legal.

- You can contest : Even in the event of a reminder, you are entitled to claim that the debt is time-barred. And no one can hold that against you.

- But you still need to know... : Too many people are unaware that a debt can be time-barred. As a result, they pay without being obliged to. That's why it's so important to know the rules, even the basics.

Why do these deadlines balance relations between the parties?

These limitation periods are not there to annoy anyone. They set out a clear framework that protects both creditor and debtor.

Are you a contractor? Do you have customers? Pending invoices? Then make a note of your dates. A forgotten receivable is often a lost receivable.

Are you an individual or professional customer? Find out more about deadlines. It's never too late to learn that it's too late!

👉 Have you ever let a debt slip through your fingers? Or, on the contrary, discovered in time that you were no longer obliged to pay?

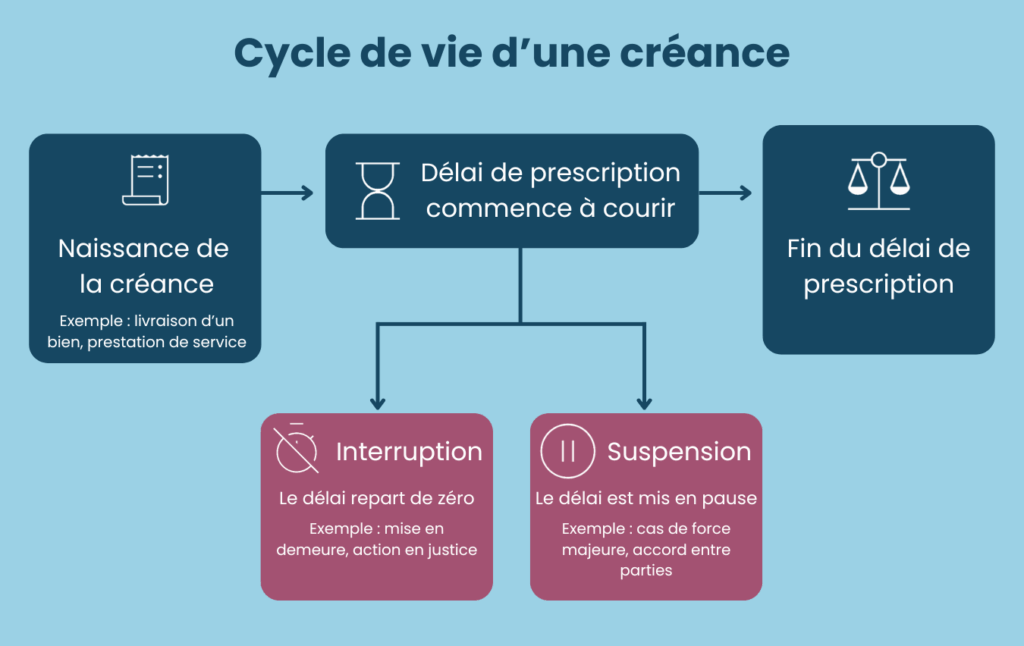

How to interrupt or suspend a limitation period?

Do prescription periods seem set in stone? Not quite. There are two very useful levers for creditors: interruption and the suspension.

Two legal tools which, when properly used, can extend the deadline for taking action.

But be careful: to use them effectively, you need to know exactly what you're doing. when and how to use it.

What is a prescription interruption?

The interruption of prescription consists of reset delayIn this case, the debtor starts from scratch. It occurs when an act or event manifests the creditor's or debtor's willingness to acknowledge or dispute the debt.

Classic interruption situations :

- Acknowledgement of debt by the debtor :

- It's often implicit, but highly effective. All it takes is an e-mail, a text message, or even a partial payment, for the debt to be recognized... and the deadline starts all over again.

- A concrete example: a tenant pays part of his unpaid rent after two years of silence. In this case, the limitation period (3 years for rent) is fully restarted from that date.

- Legal action :

- Another option is for the creditor to take the matter to court. Please note, however, that filing an application for an injunction to pay is not enough: a writ of summons must have been issued.

- ⚖️ Example A company launches legal proceedings in 2024 for an invoice issued in 2019. Even if the trial takes time, the action interrupts the statute of limitations.

- Formal notice :

- Sending a letter of formal notice by registered mail with acknowledgement of receipt can also interrupt the statute of limitations - provided it is properly documented.

- Example A landlord sends a formal notice for unpaid rent before the deadline. This restarts the meter.

What is a suspension of prescription?

Here, we don't start from scratch, we simply set the stopwatch. on pause. Once the cause of the suspension has been removed, the timeframe resumes where it left off.

Frequent suspension cases:

- Force majeure :

- Health crisis (such as COVID-19), flood, exceptional event... If the creditor is unable to act for reasons beyond his control, the time limit stops temporarily.

- 🌪️ Example: during the 2020 confinements, the statute of limitations was suspended until creditors could resume their claims.

- Debtor's legal incapacity :

- If the debtor is a minor or under guardianship, prescription is suspended until he or she regains full legal capacity.

- Example A minor inherits a debt in 2022, and the statute of limitations is suspended until he comes of age.

- Agreement between parties :

- Creditors and debtors can also agree to a temporary freeze on proceedings. In this case, the statute of limitations is suspended for the duration of the agreement.

Interruption vs. suspension: not to be confused

- Interruption = the counter resets to zero.

- Suspension = press pause... then pick up where you left off.

A combined case? It could be.

Imagine a debtor who stops paying in January 2020. The creditor sends a formal notice in January 2023 (interruption). Then a natural disaster strikes in March 2023, freezing all proceedings (suspension). What happens? The creditor benefits from an extended deadline, once the situation has returned to normal.

🎯 Moral: mastering these levers is like having a legal extension up your sleeve. But it requires rigor, timing and a healthy dose of vigilance.

Special features and exceptions to be aware of

Limitation periods follow strict rules, yes... but they're not always set in stone. Certain situations adapt or adjust these time limits according to the context. It's the famous "it depends" of the law.

Legal exceptions: reduced or specific deadlines

Certain types of claims are subject to specific limitation periods, often shorter than the standard 5-year period.

- Merchants' receivables from individuals :

- Time limit 2 years (article L218-2 of the French Consumer Code).

- Example An individual buys a product from a retailer in January 2021. Any claim for payment or refund must be made before January 2023.

- Receivables from medical services :

- Time limit 2 years (article L1142-28 of the French Public Health Code).

- Context This includes unpaid medical expenses incurred by patients.

- Example A hospital bill issued in June 2020 must be claimed before June 2022.

- Fines and offences :

- Time limits vary according to the nature of the offence:

- 1 year for fines.

- 3 years for misdemeanors.

- 10 years or more for crimes.

- Time limits vary according to the nature of the offence:

Cases of fraud or concealment

When a debtor deliberately conceals a debt, the law gives him less leeway and the deadline can be extended.

🔍 Example In 2023, you discover that your debtor has falsified documents to avoid paying you in 2020. You can benefit from an extended deadline to take action... provided you can prove it.

Contractual changes

Sometimes the parties themselves set shorter or longer deadlines in the contract. If both parties agree, and the law allows it, it's valid.

Situations of inability to act

Some circumstances simply make theimpossible action.

- Force majeure flood, fire, war...

- Debtor's absence untraceable debtor or unidentifiable assets

⛔ Example A company affected by flooding has been unable to gain access to its premises. The time limit is suspended during this period.

Beware of limits

Even with all these exceptions, the statute of limitations cannot be postponed indefinitely.

🔒 Example: in certain cases, the total duration - including interruptions - may not exceed 20 years. This is the closing clause. The story can't go on forever.

Exceptions and special features relating to limitation periods provide a degree of flexibility to suit specific situations. However, they require precise knowledge of the applicable rules if they are to be used effectively. For creditors, anticipating these specific cases can make the difference between a recovered claim and a definitive loss.

Best practices to avoid unpleasant surprises

If you're a creditor or debtor, it's in your best interest to be proactive. Here are the best reflexes to adopt to avoid losses, disputes and mistakes.

Creditors: structure, relaunch, act

Centralize your receivables with rigor

Use a tool (even a simple one) to keep track of deadlines, with automatic alerts.

🖥️ Example A well-configured CRM alerts you when a critical prescription period is approaching, giving you time to react.

Follow up regularly

Even before talking to the courts, reminding a debtor can sometimes help interrupt the delay.

📨 Example A registered letter sent on time can be enough to restart the meter... and show that you mean business.

Don't wait until the last minute

As soon as a debt approaches its "deadline", take action: formal notice, legal action...

Document everything

Keep all (we mean ALL) records: reminders, e-mails, acknowledgements, payments. These are your best weapons.

📁 Example An IOU, even a partial one, can save a claim, but you still need to prove it.

Outsource if necessary

Go to the experts: collection professionals can manage your files and avoid oversights.

📊 Advantage delegate to gain in efficiency while securing your receivables.

Debtors: vigilance and knowledge

Know your rights

A time-barred debt is no longer payable, so don't be intimidated.

🧠 Example A creditor is asking you to pay an amount that is 7 years old? First check if it's still valid before getting out your checkbook.

Keep your proof

A receipt, a bank transfer, a letter... anything can be used to show that you've paid.

🧾 Example A proof of payment is often enough to end a discussion.

Negotiate on time

Before the situation gets bogged down, propose a timetable. You'll avoid a procedure (and unnecessary stress).

💬 Example You offer to pay in three instalments. The creditor accepts: the relationship remains calm.

Dispute if necessary

If a claim is time-barred, assert it. You're within your rights.

Why are these practices essential?

Because a forgotten or poorly managed receivable means lost money for some... and sometimes money wrongly paid for others.

🎯Example of successful implementation

A B2B company uses receivables management software. As soon as a deadline approaches, a formal notice is automatically sent. Result: 98 % of recovered receivables in time.

Conclusion: time, the ally we too often forget

Limitation periods aren't just a matter of time. legal formality. It's a a real protection lever - for creditors and debtors alike.

But like any lever, you need to know when and how to activate it. Keeping track of your receivables, know your rights, anticipate deadlines These are simple but decisive reflexes.

So, are you sure you've got the timing right in your receivables management? Because sometimes, it's not the law that's missing... it's just the calendar you forgot to consult.