It is no secret that the accumulation of outstanding invoices can quickly threaten a company's financial stability, which is why it is essential to control the risks of customer default.

So how do you preserve your cash flow? It is simple: customer portfolio analysis.

This service is offered in partnership with Creditsafethe specialist in corporate credit reports.

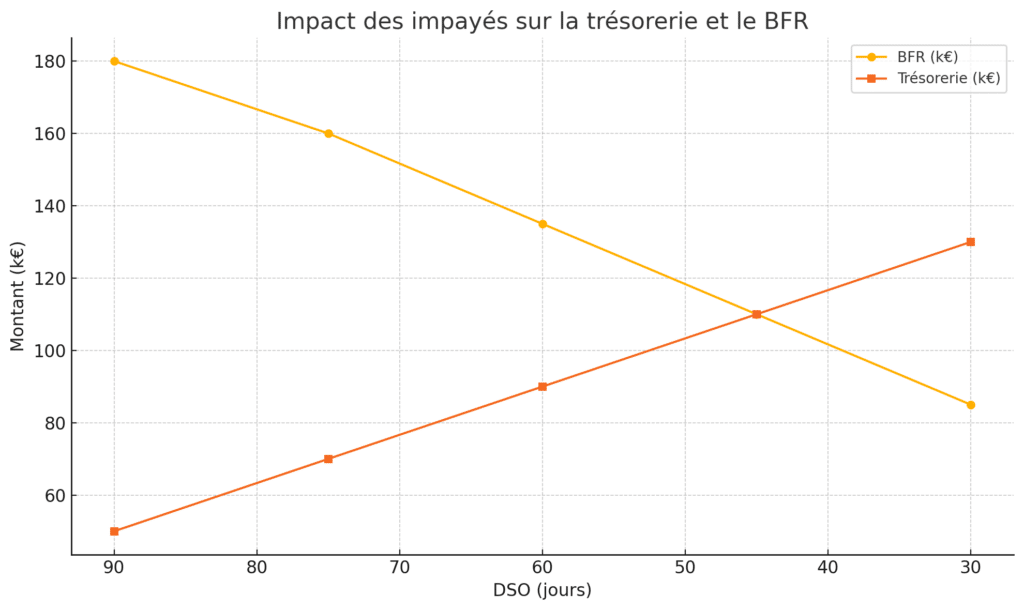

Have you ever wondered what really lies behind your outstanding invoices ? These are not just sums on hold: they directly increase your Working Capital Requirement (WCR), in other words, they tie up the money you need to invest and grow.

Take this SME, for example, which thought it was doing the right thing by granting flexible payment terms to all its customers. The result? A DSO (the average time to get paid) which doubled in six months, frozen investments, and a race against time to pay suppliers. Here, the company's mistake is to have treated all customers in the same way, without distinguishing between good payers and "risky" customers.

In concrete terms, what do you risk without a good management of your customer portfolio ?

High DSO = cash flow in difficulty and, above all, greater vulnerability to unforeseen events.

Legal proceedings are very expensive, not to mention the bad debt losses. Just one word: anticipate !

Knowing your customers means being sure to making the right choices for your business. Don't give more credit to a company that's already financially vulnerable.

So, how confident are you that you know exactly who your at-risk customers are today?

A detailed analysis of your customer portfoliois like having a magnifying glass on your your partners' financial health. But in practical terms, what does this mean in everyday life?

How to avoid unpleasant surprises? By identifying customers whose payments fluctuate between late and regular. By doing so, you can adjust your credit terms or ask for guarantees, such as imposing down payments on certain customers whose financial health is fragile or whose payment behavior fluctuates.

With predictable inflows, you can plan your investments with peace of mind. Imagine being able to say "yes" to an exceptional supplier discount... because you know exactly when the money will arrive.

Reducing your DSO (Days Sales Outstanding) frees up cash that can be immediately reinvested in other strategic projects.

By targeting at-risk customers, you focus your efforts where they'll do the most good, and above all you maintain trust with reliable customers.

Healthy cash flow means being able to seize a takeover opportunity or launch a new product when your competitors are in survival mode.

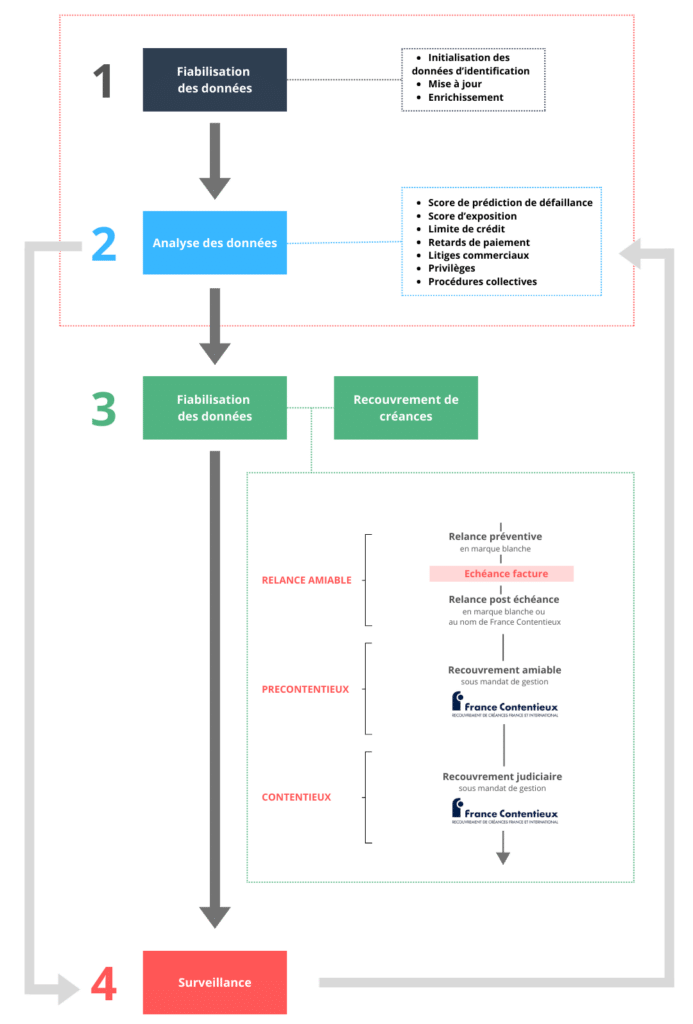

Thanks to the synergy of skills between Konecta, France Litigation and Creditsafewe can help you master and optimize your Order-to-Cash value chain processes. In simple terms, this translates into free analysis of your customer portfolio to prevent problems from becoming unmanageable. The overall idea is to be able to identify and understand different risk profiles of your customers to better prioritize your collection actions.

1

We gather and centralize all relevant information on your customers (payment history, solvency, past disputes, etc.).

2

Thanks to high-performance tools boosted by AI, we study the data collected to clearly identify at-risk profiles. We classify risks into 3 categories:

3

We give you the keys to take action, with detailed reports and concrete actions to implement.

Your portfolio analysis report includes :

Example of a situation An SME faced with an increase in unpaid invoices called on our services. It discovered that 40% of its unpaid invoices came from a single sector. By adjusting its payment terms, it reduced its losses by 25% in three months.

To carry out the analysis of your customer portfolio, we need an Excel file with the following information: Siren (if available), company name and full address.

Following the analysis, in order to gain a better understanding of the customer profile, we can enrich your file with all available and constantly updated DATAS (VAT registration number, NAF, activity, legal form, workforce, financial data, scoring, credit limit, DBT score, name of managers.....).

The strengths of our approach :

Customer portfolio analysis enables you to identify at-risk customers before they become overdue. By categorizing profiles according to their payment behavior and financial strength, you can anticipate delays, reduce losses and secure your cash flow. It's the first step to intelligent, preventive collections.

Without rigorous analysis, you're exposing yourself to longer DSO (Days Sales Outstanding), higher working capital requirements (WCR), costly legal fees in the event of contentious collection, and even permanent losses on receivables. Worse still, an unstable customer can have a domino effect on your business.

It follows three key stages:

The analysis is based on several key data points: payment history, incident rate, solvency score, business sector, legal form, workforce, financial statements, supplier behavior (DBT), and sector risk level. These elements provide a clear, objective view of each customer.

Companies are seeing a significant reduction in overdue receivables, improved cash flow, greater ability to plan investments and optimization of their collection strategy. For example, targeting a problem area identified by the analysis can be enough to reduce losses by 25 %.

A simple Excel file is all you need, containing: the SIREN number (if available), company name and full address of your customers. From there, the analysis can be enriched with up-to-date data such as financial scoring, sales, credit limit, legal structure or management.